What's new

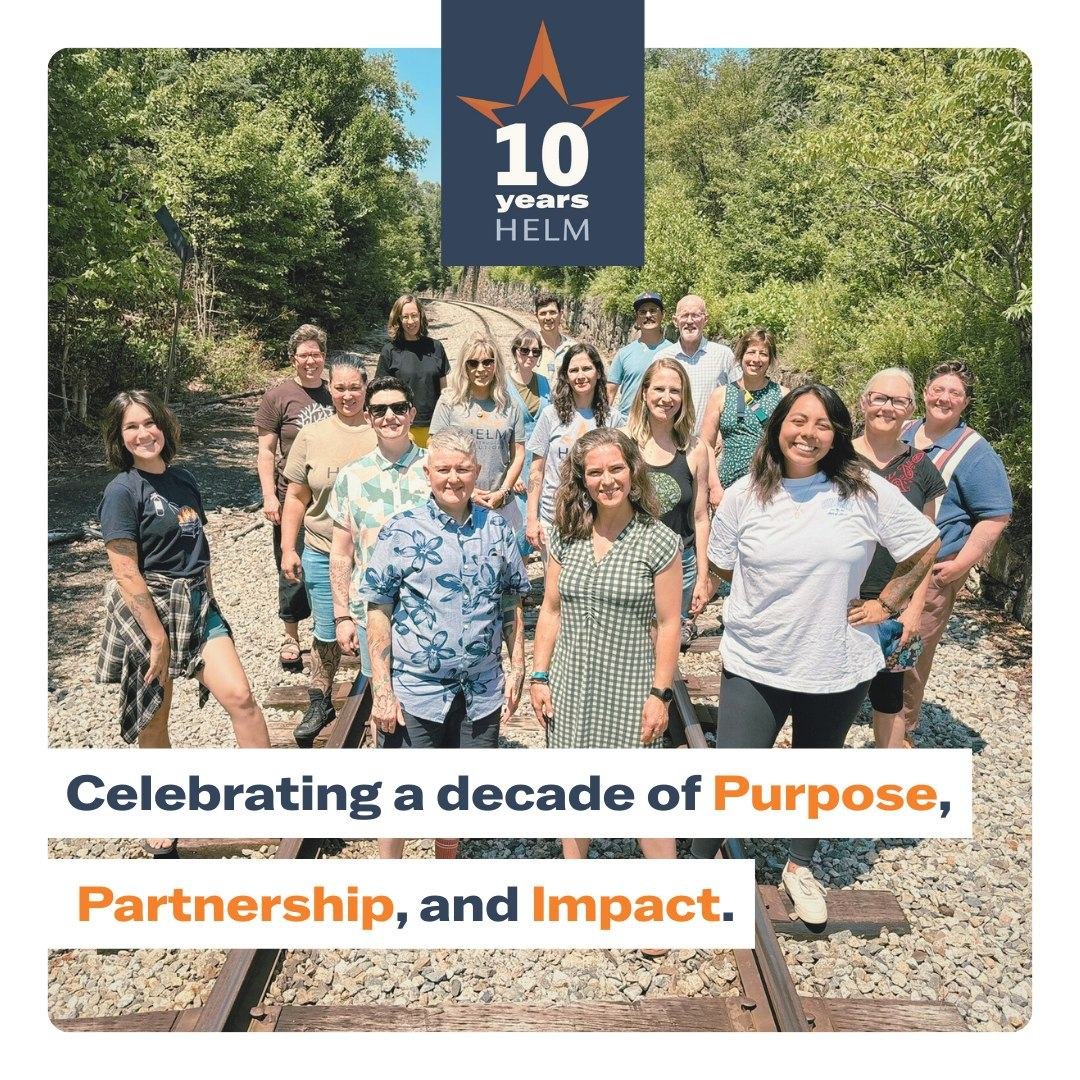

There's always a ton happening at HELM: Classes, community events, guest appearances — you name it — we're busy supporting our clients, working to transform the construction industry, and building a bigger Helmiverse. (Yep, it's a thing.) Jump in!

Building Justice: Rethinking Construction, Climate, and Care

Construction sits at the intersection of some of today’s most urgent challenges—workforce shortages, climate change, housing insecurity, and culture change. It’s also where solutions are being built, literally and figuratively.

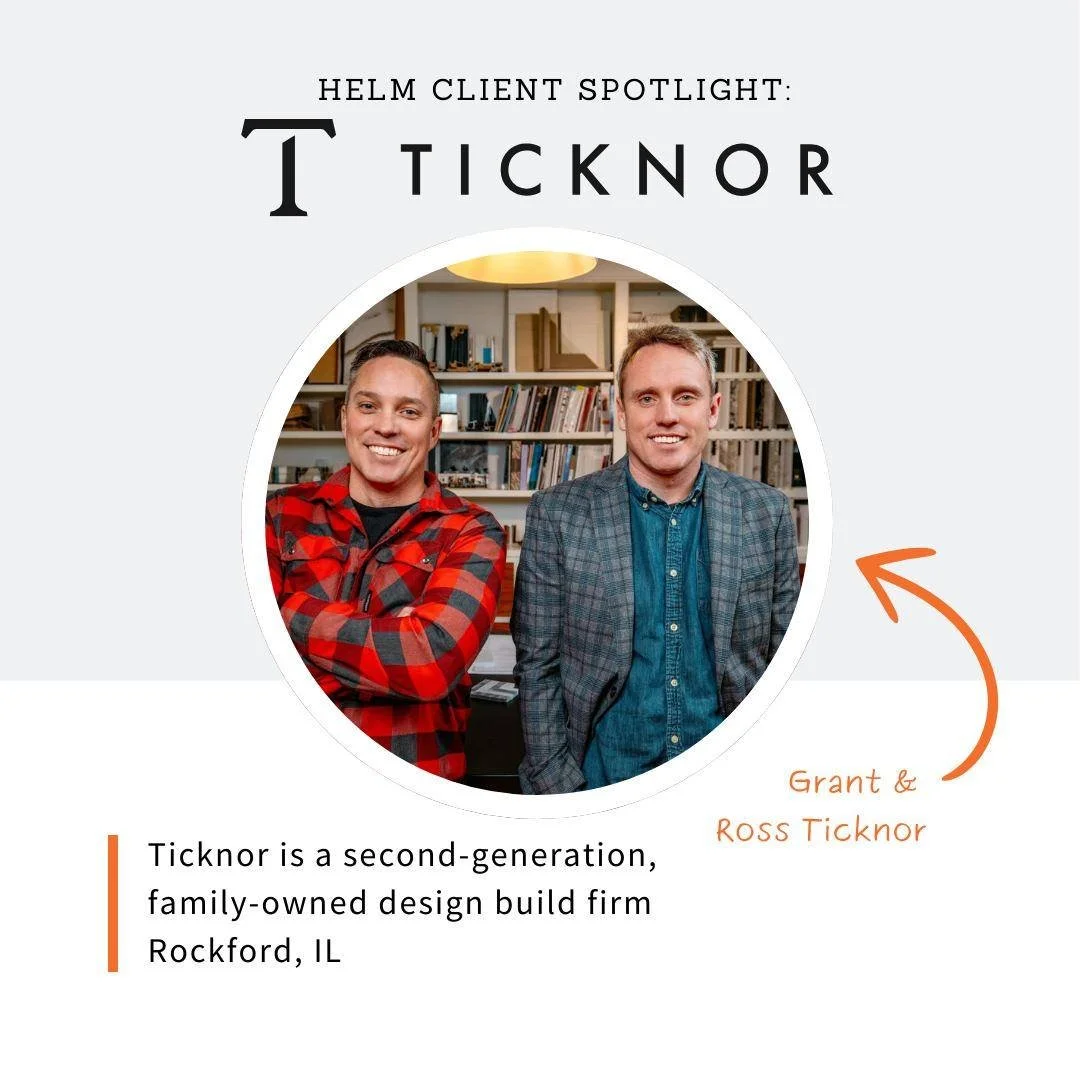

In this episode, host Tim Cynova continues the Climate Justice HR series with HELM co-founders, Mel Baiser and Kate Stephenson, a people- and planet-forward consulting firm helping construction companies transform their culture, strengthen business resilience, and lead on climate action.

They explore:

What it means to embed justice, care, and clarity into hiring, leadership, and everyday operations.

Why construction’s cultural transformation could unlock lessons for every sector.

How HELM helps companies evolve from “chaotic job sites” to thriving, values-aligned workplaces.

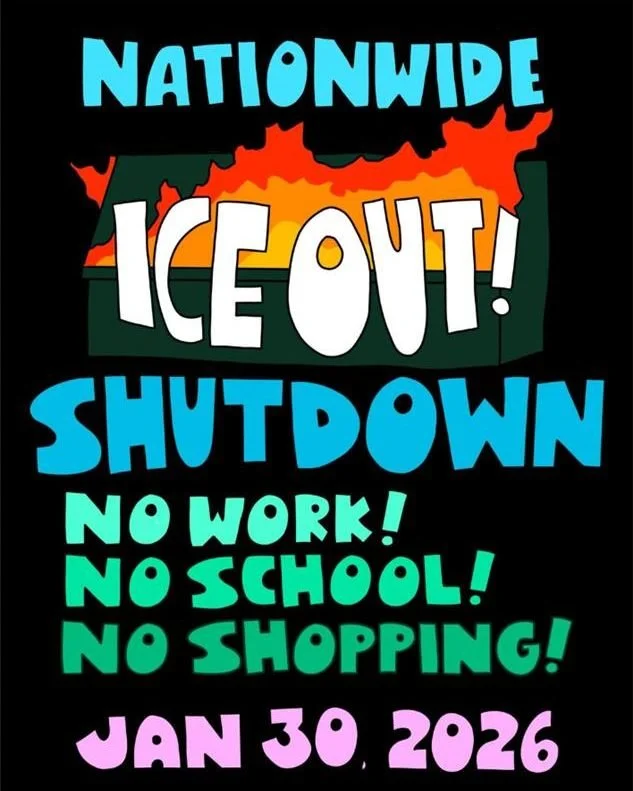

The industry’s overlapping crises—from labor shortages and mental-health challenges to ICE raids and climate emergencies.

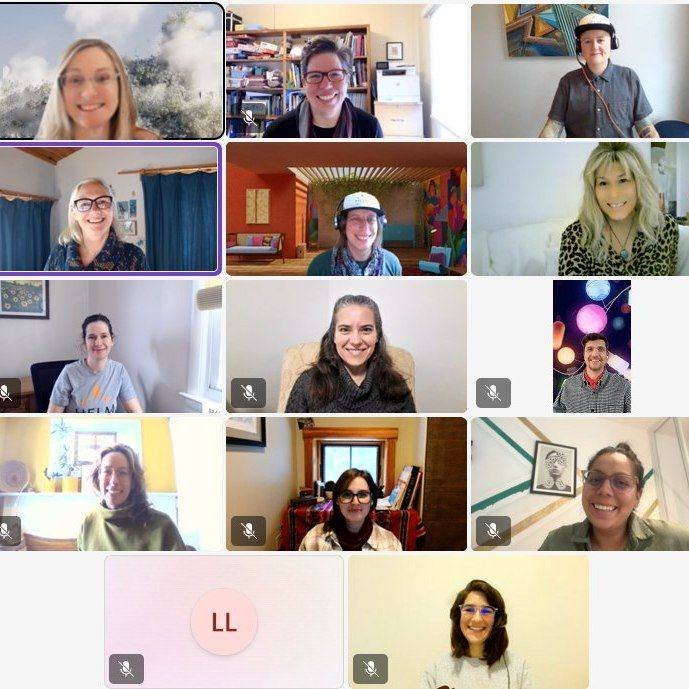

How coaching, community-building, and shared learning can shift entire systems, not just individual job sites.

Despite the gravity of the challenges, Mel and Kate also share a deep sense of hope—that by centering connection, humility, and interdependence, we can build not only structures but the systems that sustain us.